An earlier just-the-numbers analysis outlined the basics of five frac sand companies, but the sand landscape is literally and figuratively changing weekly, so investors will find an update useful. In particular, companies are expanding into a third geographic area; are confronting ferocious and expert competition from private sand companies as well as large turnkey companies; are experiencing both rail and truck transportation limits into the Permian; continue diversifying into non-Permian plays; are grappling with key safety and environmental regulations; and from an overall perspective, continue to deal with the major underlying factor: volatile oil prices affecting demand. In this environment, three sand-only public companies are adapting well and a fourth high-profile merger is about to list publicly.

The three companies are Hi-Crush LP (HCLP), Smart Sand (SND), and US Silica (SLCA). The merged companies are Fairmont Santrol and Unimin, which will go public June 1 as Covia with stock symbol CVIA.

Private-Company Sand SuppliersA recent oilfield conference featured talks and displays by some of the following sand suppliers: Alpine Silica, Atlas Sand, Black Mountain Sand, High Roller Sand, Preferred Sands, Select Sands, Sierra Frac Sand, Superior Silica Sands, and Vista Proppants and Logistics. All are private except Select Sands, which trades on the OTC market.

Other Public Competitors, Bundled-Service Competitors, and Third- Derivative CompaniesTwo public sand/proppant-only companies catching up to competition are CARBOCeramics and Emerge Energy Services.

Three companies that bundle frac sand supply into their service suite are Halliburton (HAL), Mammoth Energy (TUSK), and Schlumberger (SLB). Notably, Halliburton blamed its first quarter 2018 loss on delays in transporting sand by rail from North Dakota to the Permian Basin. Mammoth Energy has three sand sub-divisions - Muskie, Piranha, Taylor - which each supply from different mines.

There are also companies serving the oil industry that specialize in sand inventory management - but don��t own mines - or in dust control. Investors can consider them ��third-derivative companies:�� in that the leading factor is oil price, the first derivative of which is oil demand, a second derivative is frac sand supply, and a third derivative is ancillary sand services.

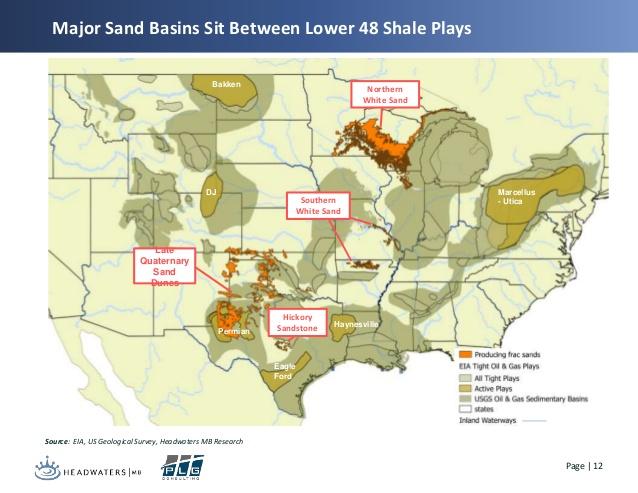

The biggest locations for frac sand mines have expanded from one to two to three. The first were the Northern White/��Wisconsin�� (really, Minnesota-Wisconsin-Northern Illinois) sand mines. They remain a potent force due to market penetration, reasonable cost, and performance of Northern White sand in fracturing.

But producers first exerted cost pressure and then saw better results by using larger volumes of sand, a second source was developed. These mines are in central Texas, shown above as ��Hickory Sandstone�� and their product is referred to ��regional sand,�� or ��Brady Brown.�� Due to their location, this sand doesn��t require as much long-haul rail freight cost or occasionally-fraught logistics. However, some producers have not been happy with its turbidity (cloudiness).

Finally, experienced oil field producers noticed potentially-usable sand within the Permian basin. Its quality is similar to Wisconsin sand and its location in Winkler County is roughly between the Midland and the Delaware sub-basins of the Permian. So it checks the quality and the no-rail transport boxes. This third region is referred to as ��in-basin�� or sometimes ��Winkler trend�� sand.

Smart Sand has one Wisconsin mine. Hi-Crush has four Wisconsin mines, including two dedicated to the Permian Basin, and one in-basin mine, open since 2017. US Silica has five Northern White mines, three regional mines, and two in-basin (Texas Permian) mines that were announced in September 2017.

Dunes Sagebrush Lizard And In-Basin SandPermian drillers generally, and companies developing in-basin sand avoid the habitat of the dunes sagebrush lizard: far southeast New Mexico and four nearby Texas counties. Rules protecting the lizard in the Texas Conservation Plan, as delegated from the US Fish and Wildlife Service, are currently being rewritten partly because they apply only to oil and gas companies. Two private sand companies, Black Mountain and Vista, have grandfathered properties and so would not be affected by any change in regulations, while a third, Atlas Sand, has been careful to keep its development away from the protected area. However, these limitations will restrict some development of in-basin sand mines.

CoviaUnimin, the largest (and formerly-private) sand company and Fairmont Santrol, the third largest, are combining their sand operations into a new NYMEX-listed company, Covia. Covia is expected to begin trading June 1, 2018. It will be the largest sand company, with 1.4 billion tons of reserves and 45 million tons per year of capacity. Had it been operating as a combined entity in 2017, its sand production would have been 36 million tons.

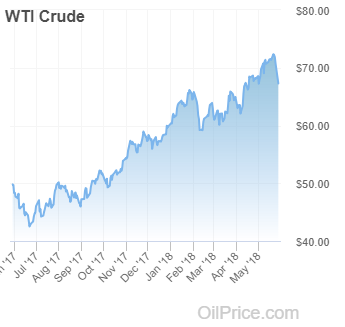

The May 24th closing oil price was $67.88 per barrel for West Texas Intermediate (WTI) crude oil, below recent highs on storage builds and news that Russian and Saudi Arabia plan to increase oil production.

The December 2018 NYMEX price is lower at $66.36 per barrel and the December 2019 NYMEX oil price is below that, at $61.31 per barrel. Lower oil prices and Permian transport limitations described below could reduce Permian oil drilling and thus the requirements for sand.

Sand Demand and Capacity EstimatesWest Texas sand demand estimates range from 40-60 million tons per year, while Seaport Global estimates total demand of 100 million tons per year. Hi-Crush estimates 25-30 million tons per year of eight in-basin Permian mines will be available to the market this year.

Hi-Crush��s sand capacity is 13.4 million tons per year with 2017 production of 8.9 million tons. Smart Sand��s capacity is 3.3 million tons per year with 2017 production of 2.4 million tons. Including 9.5 million tons per year of capacity expansion, US Silica has 25 million tons per year of capacity for oil and gas proppant sand and in 2017 produced 15.1 million tons. Clearly, Covia will be the volume leader.

Permian Takeaway LimitsThe huge increase in US production, to 10.7 million barrels per day (BPD), and within that Permian production, at 3.2 million BPD, has pushed all kinds of transportation to their limits in west Texas. The first is the broad limit on pipeline (and refining) takeaway capacity for oil, natural gas liquids, and natural gas. That is expected to be remedied by the end of 2019.

The second limit is trucking and truckers. There simply are not enough to haul the oil that can��t go into pipelines, fresh water that isn��t pipelined and recycled water. For example, in the last few months, the Permian region has added 70,000 BPD of oil production per month to the 3 million plus total. However, PLG Consulting estimates that if transported only by truck, just about half of that, or 40,000 BPD, requires 600 new truck drivers.

Specifically for sand, there is not enough trucking capacity (and roads) to either get regional sand from its Texas mine to the well-site or ��last-mile�� capacity to get Wisconsin sand from a Texas railroad terminal or in-basin sand from Winkler County to the well-site.

Indeed, companies go so far as to map congestion at specific intersections in small West Texas cities like Kermit and Monahans, try to spread their plant and terminal pick-ups throughout the day, and calculate the Texas Department of Transportation (TxDOT) weigh limits to the pound. For sand trucks in Texas the limit is 84,000 pounds; companies have discussed trying to get the limit raised to Colorado��s 93,000 pounds.

Finally, for Wisconsin sand, long-haul rail transportation has also been constrained, leading to delivery delays for sand from those mines. Along with Halliburton, Hi-Crush noted that such delays affected its first-quarter results.

Thus, supply from each source can have issues, although HCLP notes that its Texas rail terminals are closer to well-sites than even the in-basin sand in Winkler County. Again, Smart Sand has one Wisconsin mine, Hi-Crush has four Wisconsin mines and one in-basin mine, and US Silica has five Wisconsin mines, three regional brown mines and two in-basin mines.

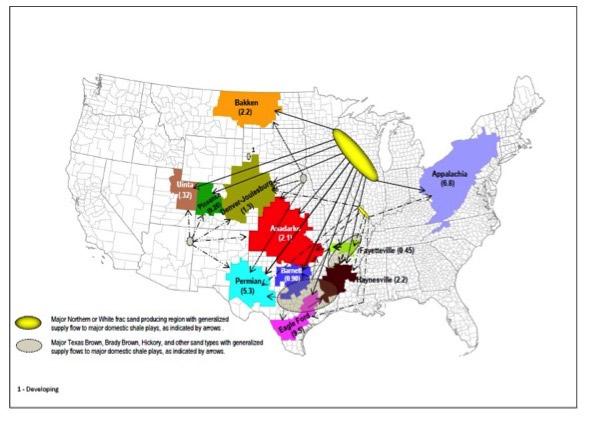

Offsets To Permian Basin CongestionIn general, the closer a mine or a rail terminal is to Permian wellsites, the better, and each of these companies has one or both advantages for their mines. As the map below shows, basin diversification also helps: two of Hi-Crush��s four Wisconsin mines serve Marcellus-Utica (Appalachian) drilling and Smart Sand has a new North Dakota terminal allowing it to also serve the nearby North Dakota Bakken, as can the Northern White mines of Hi-Crush and US Silica.

Credit: Rock Products, 2015 (Permian in-basin mines not shown)

New Silica Dust RegulationIn June 2018, new Occupational Safety and Health Agency (OSHA) regulations go into effect for sand, glass, construction, and ceramic workers�� exposure to silica dust. OSHA lowers the permissible exposure level (PEL) to 50 micrograms per cubic meter over an eight-hour time-weighted average. All workers exposed to sand at any location are covered, and it will apply to all who work with sand.

Nanoparticle or Nanoproppant Technology A Competitor?Using nanoparticles or nanoproppant, which in their size and fluidity appear to resemble a fluid cracking (FCCU) catalyst, sounds like a potentially-appealing fracking technology based apparently on less water use and more surface area exposure than larger sand particles.

However, the technology falls prey to the marginal cost of fracking, or any process. Fracking is essentially putting one set of materials (sand, water) into the ground to extract another material (oil and other hydrocarbons). The economic prime directive is what drillers put into the ground cannot cost more than what they get out of the ground. The problem with nanoparticles, as with any manufactured proppant like resin-coated sand or ceramics, are their high cost relative to sand, especially when considering the millions of pounds required for hydraulic fracturing.

Moreover, nanoparticles, which some consider similar to very fine 200-mesh or 300-mesh sand (100-mesh and 40/70 mesh are used now), could easily add to the burden of complying with the dust regulations mentioned above.

Capitalization, Stock Price, And Current Vs. 52-week HighBased on May 25th, 2018 closing prices, US Silica has the largest market capitalization at $2.4 billion, followed by Hi-Crush at $1.2 billion and trailed by the much smaller Smart Sand at $250 million.

5/25 | 52-wk | Current | |

Symbol | Price | high | to high |

HCLP Hi-Crush LP | 13.15 | 14.85 | 89% |

SLCA US Silica | 30.93 | 39.21 | 79% |

SND Smart Sand | 6.09 | 11.06 | 55% |

The current ratio is the ratio of a company��s current assets to its current liabilities. A ratio of 1.0 is a minimum desired level: the current ratios for these three companies range from 1.6 to 4.6.

Smart Sand does not pay a dividend. US Silica��s $0.25/share provides a 0.8% yield and Hi-Crush LP��s $0.90/partnership unit gives a 6.8% return.

Hi-Crush has a price-to-earnings (P/E) ratio of 8; Smart Sand has a P/E of 11 and US Silica has a P/E of 17.

Liability-To-Asset And Short RatiosThe three companies have low liability-to-asset ratios, which suggest financial flexibility: Smart Sand is at 25%, Hi-Crush LP is 27% and US Silica is a steeper 41%.

The percentage of shares shorted, a measure of investor skepticism, is modest and similar for all three companies at 15-18%.

Limited Partnership IssueOf the three companies, only Hi-Crush is a limited partnership. Investors should consider their individual tax position before investing.

EV/EBITDA Ratio And Return RatiosEV/EBITDA ratio is the ratio of a company��s enterprise value divided by its earnings before interest, taxes, depreciation, and amortization. A ratio below 10 suggests a prospective investment and two of the companies are below or at the target: Hi-Crush at 7.2, US Silica at 9.1. Smart Sand is not far off at 10.6.

The companies have good returns on assets at 9.2% for Hi-Crush, 5.8% for US Silica, and 5.1% for Smart Sand. Returns on equity were a similarly solid 18.5% for Hi-Crush, 13.3% for US Silica, and 12.0% for Smart Sand.

RisksSummarizing the risks that have been described: the biggest one is a fall in oil price that would reduce drilling incentives, with Permian basin inbound and outbound congestion across every factor (crude, natural gas, water, sand, and especially labor for fracturing, completion, and trucking) a close second. Long-haul rail constraints are another limitation, along with the sheer growth (and lack of roads) in the Permian. Finally, the sheer size of Covia could act to drive down sand prices.

RecommendationsBased on these numbers, potential investors are encouraged to consider investing in US Silica, Hi-Crush, and Smart Sand. Depending on investors�� individual tax situations and changes under the new law investors may want to consider Hi-Crush Limited Partnership for its high yield of 6.8% and its new in-basin mines.

US Silica continues with its large stable market cap, 100+ year history, solid returns and good diversification into industrial specialty products. And despite its small size, I also recommend Smart Sand given its attractively low debt level and upside to its one-year target. With its new North Dakota terminal Smart Sand can readily diversify its sales into the Bakken in addition to the Permian.

Finally, while a recommendation about new IPOs is beyond the scope of this analysis, investors may want to follow up on Covia, a new company resulting from the combination of Fairmont Santrol and Unimin.

Investors should consider factors in these three companies�� current operations, as well as their future earnings, strategies, and issues. These include a possible downturn in the crude oil market, fierce competition between sand suppliers, and any changes that reduce the use of sand in hydraulic fracturing.

While you're here, consider subscribing to Econ-Based Energy Investing, a Seeking Alpha Marketplace platform. Weekly in-depth articles provide you with recommendations for long energy investments.

Subscribers get actionable ideas, make decisions with larger industry context, and save time on research. My service focuses on publicly-traded small & mid-cap oil producers (by basin) & refiners (by area) drawing from a public energy space spanning more than 400 companies.

I��m an industry insider with +30 years' experience working for & investing in energy companies. As you plan your research and investing strategies for the year, consider Econ-Based Energy Investing.

Disclosure: I am/we are long TUSK.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Traders purchased shares of Pfizer Inc. (NYSE:PFE) on weakness during trading on Thursday. $142.15 million flowed into the stock on the tick-up and $59.64 million flowed out of the stock on the tick-down, for a money net flow of $82.51 million into the stock. Of all equities tracked, Pfizer had the 12th highest net in-flow for the day. Pfizer traded down ($0.08) for the day and closed at $35.89

Traders purchased shares of Pfizer Inc. (NYSE:PFE) on weakness during trading on Thursday. $142.15 million flowed into the stock on the tick-up and $59.64 million flowed out of the stock on the tick-down, for a money net flow of $82.51 million into the stock. Of all equities tracked, Pfizer had the 12th highest net in-flow for the day. Pfizer traded down ($0.08) for the day and closed at $35.89

S&P Dow Jones Indices

S&P Dow Jones Indices